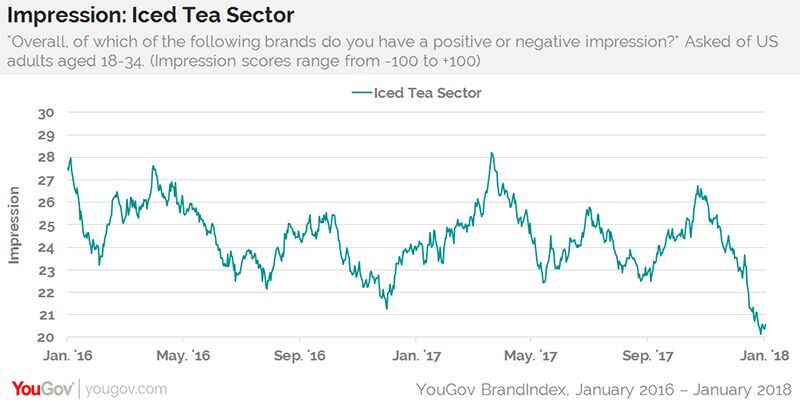

American millennials may be losing their taste for iced tea, according to results of a poll released this month by YouGov BrandIndex. The “brand intelligence service” focuses on public perception of brands across many sectors and nations, providing insights to industries such as food and beverage.

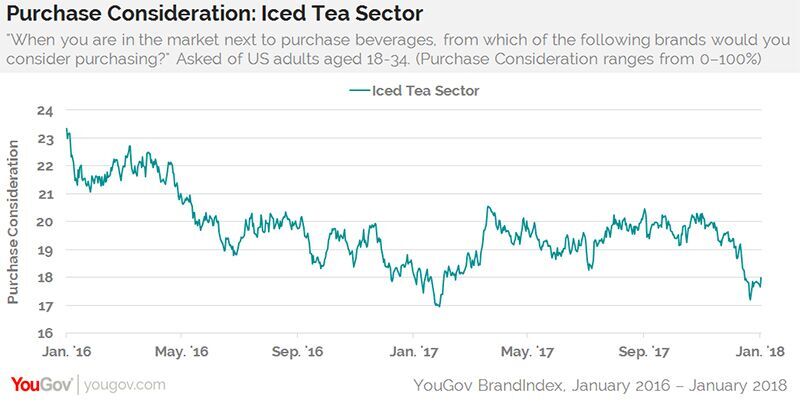

Its findings on iced tea are based on polls conducted during the last two years with adults between 18 and 34 years of age. In January 2016, 23 percent of millennials said they’d consider buying iced tea the next time they were purchasing a beverage. Currently, that percentage is down to 18 percent.

American millennials may be losing their taste for iced tea, according to results of a poll released this month by YouGov BrandIndex. The “brand intelligence service” focuses on public perception of brands across many sectors and nations, providing insights to industries such as food and beverage.

Its findings on iced tea are based on polls conducted during the last two years with adults between 18 and 34 years of age. In January 2016, 23 percent of millennials said they’d consider buying iced tea the next time they were purchasing a beverage. Currently, that percentage is down to 18 percent.

Brands associated with high sugar content or high-fructose corn syrup, colorings or artificial flavorings are seeing the quickest retreat from customers, as younger Americans increasingly seek out healthier ways to quench their thirst, especially in recent months, says the report.

“Lipton, Nestea, Crystal Light and Snapple have been trending downward in this metric from the end of October [2017] through the present. Only Arizona Iced Tea has had a relatively stable trajectory,” the report states, noting that Crystal Light—an iced tea drink mix containing artificial flavors, preservatives, and red, yellow, and blue food dyes—has been hit the hardest, dropping a full eight percentage points over the past two years. (This, despite its stevia-sweetened and naturally colored “Pure” variety, launched in 2010.)

“While no outstanding incident occurred since the end of October to impact these scores, the main culprit may be millennial interest in personal health and their aversion to sugar,” continues the report. “Much has been written about sugar content in bottled iced teas, while bottled waters and health beverage sales increased.”

According to recently released figures from IRI, a global provider of market information solutions, for the 52 weeks ending Dec. 3, 2017, unit sales of instant tea mixes are down by 7 percent and while RTD canned and bottled tea as a category has maintained its sales level from the previous year, several varieties, including Snapple and Arizona canned and bottled teas, have experienced a reduction in unit sales. More healthy options such as Peace Tea, an RTD tea beverage that contains no artificial flavors or colorings (it does contain sucralose artificial sweetener) are bucking the downward trend; its unit sales rose 30 percent last year.

Brands associated with high sugar content or high-fructose corn syrup, colorings or artificial flavorings are seeing the quickest retreat from customers, as younger Americans increasingly seek out healthier ways to quench their thirst, especially in recent months, says the report.

“Lipton, Nestea, Crystal Light and Snapple have been trending downward in this metric from the end of October [2017] through the present. Only Arizona Iced Tea has had a relatively stable trajectory,” the report states, noting that Crystal Light—an iced tea drink mix containing artificial flavors, preservatives, and red, yellow, and blue food dyes—has been hit the hardest, dropping a full eight percentage points over the past two years. (This, despite its stevia-sweetened and naturally colored “Pure” variety, launched in 2010.)

“While no outstanding incident occurred since the end of October to impact these scores, the main culprit may be millennial interest in personal health and their aversion to sugar,” continues the report. “Much has been written about sugar content in bottled iced teas, while bottled waters and health beverage sales increased.”

According to recently released figures from IRI, a global provider of market information solutions, for the 52 weeks ending Dec. 3, 2017, unit sales of instant tea mixes are down by 7 percent and while RTD canned and bottled tea as a category has maintained its sales level from the previous year, several varieties, including Snapple and Arizona canned and bottled teas, have experienced a reduction in unit sales. More healthy options such as Peace Tea, an RTD tea beverage that contains no artificial flavors or colorings (it does contain sucralose artificial sweetener) are bucking the downward trend; its unit sales rose 30 percent last year.

In the refrigerated (RFG) teas category, IRI figures show a relatively modest 3 percent increase in unit sales from the previous year, mainly boosted by healthier brands such as Milo’s Tea (up 18 percent) and Lipton Pure Leaf (up 36 percent). But outpacing every product in the RFG tea category is kombucha, a trending tea-based product known for its health benefits and natural ingredients. Health Ade Kombucha saw a whopping 223 percent increase in unit sales, Humm Kombucha increased by 155 percent, KeVita by 115 percent, and kombucha market leader GTS experienced more than 15 percent increase in sales.

These figures indicate that iced tea remains a popular drink with strong sales (the entire RFG category was worth close to $1.3 billion in 2017, up almost 7 percent on the previous year), but that natural and health-focused iced teas are where most of the growth is occurring. If the all-important millennial crowd is to be retained, or lured back to iced tea from other, healthier beverages, those healthy options will surely become vital to the sector’s success.

Source: IRI, BrandIndex

In the refrigerated (RFG) teas category, IRI figures show a relatively modest 3 percent increase in unit sales from the previous year, mainly boosted by healthier brands such as Milo’s Tea (up 18 percent) and Lipton Pure Leaf (up 36 percent). But outpacing every product in the RFG tea category is kombucha, a trending tea-based product known for its health benefits and natural ingredients. Health Ade Kombucha saw a whopping 223 percent increase in unit sales, Humm Kombucha increased by 155 percent, KeVita by 115 percent, and kombucha market leader GTS experienced more than 15 percent increase in sales.

These figures indicate that iced tea remains a popular drink with strong sales (the entire RFG category was worth close to $1.3 billion in 2017, up almost 7 percent on the previous year), but that natural and health-focused iced teas are where most of the growth is occurring. If the all-important millennial crowd is to be retained, or lured back to iced tea from other, healthier beverages, those healthy options will surely become vital to the sector’s success.

Source: IRI, BrandIndex